As with all topics, it’s best to start at the beginning with the simple steps first.

Sorting out Your Finances

In order to make decisions about what steps to take with the various aspects of your personal financial planning it is important to take a “snapshot” of where you are at at this moment in time.

A plan is just that – a plan – you decide on where it is you want to “arrive”, consider your current “position” , weigh up the various methods of getting there and choose the path which seems most appropriate to your current family situation, income profile, future employment prospects.

Where am I now?

There are three basic areas which you need to give serious consideration to which will help you formulate in your mind the starting point for your journey through your personal finances!

1. What do I OWN?

2. What do I OWE?

3. Who owes ME?

This will create a snapshot of your current “ME” position. In terms of what do I OWN – do you own your own house (what is its value?), what savings do I have? What investments do I currently have?

Basically, you need to consider all assets, either tangible or intangible.

Is a car an asset or liability? In one respect it is an asset as it allows you to travel to and from work, allows you to earn a living, saves you TIME not having to walk.

But in another respect it is a liability – you need to buy it, service the car loan, put fuel in it, maintain it, insure and tax it, then after several years and £1,000’s of depreciation you have to swap it in for a newer car.

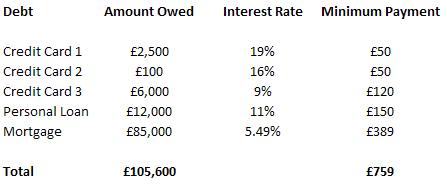

After you have made a list of all your assets you need then to consider all your liabilities – just how much do you owe, how much is it costing to owe that money (interest rate) and is the amount you owe rising or falling over time?

Finally also consider all amounts owed to you – who owes you money? What is the prospect of it being repaid?! This money owed to you is an asset.

Finally consider all the “intangible” assets you own – these are not physical items like cars, jewellery, shares in companies etc. These are the skills, qualifications, knowledge, contacts and relationships – for many people when they are starting out in life these “intangibles” are considerably more valuable than the “tangibles”. In an ideal world, over time in order to build your wealth you need to follow this formula: –

“intangibles” + time = “tangibles”

4. How much cash is left over each month?

When you first start out on your wealth-building path you will generally start with very few “tangible” assets – you have skills, qualifications, drive and determination, perseverance etc. but you have very little in terms of assets – cash, investments, etc.

There are two main ways to increase your personal wealth – earn more than you spend and grow what you already own. Don’t count on inheritances as they may never come – the cost of residential care for the elderly will wipe out the majority of inheritances in the current economic and demographic climate.

Budgeting – Needs and Wants

Most people, us included, will have a set monthly income and expenditure. Have you actually analysed what you have coming in and going out each month?

It would be wise therefore to sit down and go through bank statements, bills etc and work out exactly just what you have coming in each month and what you spend it on.

The title of this article is “Needs and Wants” – all our expenditure can be split between being either a “need” or a “want”.

Accommodation – a “need” for all of us – as is food, clothing, water, heat and light.

“Wants” – these are all the other things – we may “want” the top package from our satellite TV provider – but do we “need” it?

The goal here is to identify all those items which you buy on a monthly basis which are “wants” and not “needs” – for every transaction simply ask yourself “Do we need this or do we want this?”

If it’s a “want” – ask yourself – should I spend my money on this “want” now which will give me some short-term pleasure or should I save the money so I can have more “wants” tomorrow????

This article links into the other article – “Pay Yourself First”

Please let me know what you think? Have you sat down and gone through and identified where you are wasting money each month – an increasingly important activity for many people with the “credit crunch” and current economic climate.