I was reading an excellent post over at Seth Godin’s blog which got me thinking about budgeting, wealth and financial independence.

The article talks about how over 2 billion people on this planet live below the poverty line. Now for one moment, the chances are that if you are reading this article, you are not living in the abject poverty being suffered around the world but you could be in a state of personal financial “poverty”.

Do you spend more than you earn? Does more money float out of your bank account each month than flows in?

If you spend just one more £1 than you earn each month, you will get further and further into debt. If you spend £1 less than you earn each month that is £1 extra put in reserve.

To achieve financial freedom in your life time you need to spend money only on necessities, and save for a later time, when you can afford to buy luxuries.

Actions:

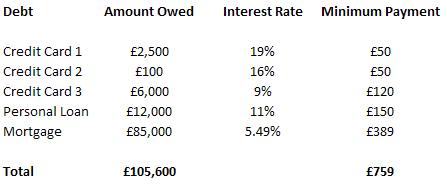

1. Prioritise your debts – pay those carrying the higher interest rates first

2. Draw up a cashflow forecast – see how your money comes and goes each month over the next 12 months.

3. Prune all those “luxuries” you don’t need – e.g. possibly downgrade on your satellite or cable package, cancel that gym membership you never use.

4. Destroy those credit cards – only use cash for purchases – open a separate savings account for those large, one-off purchases you need to make each year.

5. Live by the mantra, “10% of all I earn is mine to keep forever”.

What else can I add to this list – please comment below.