What is an investment bond?

An investment bond is, from a technical point of view, a “single premium, non-qualifying, whole of life assurance policy” for which the main principle is one of investment.

They are offered by life insurance companies as a place to invest money over the medium to long term with a view to either providing capital growth, “income” or both.

Non-qualifying relates to the tax treatment of the investment bond – the contract is essentially a life insurance policy which has been designed to be used as an investment vehicle.

Investment Options

The life company offering the investment bond will have a portfolio of funds, possibly both internal and externally managed funds, into which money can be invested. These will cover such asset classes as stocks and shares, commercial property, corporate bonds, fixed interest securities, gilts and government bonds, as well as cash.

Money can normally be invested in more than one fund at a time – typically 10 or more funds at one time is not uncommon.

Taxation of Investment Bonds

Taxation of investment bonds is a little beyond the scope of this article – we strongly recommend that you seek guidance from an accountant or financial adviser before making any amendments to any existing investment bond you may hold.

The investment bond is deemed to have paid basic rate income tax within the fund, however, many funds actually suffer a lower tax charge internally than basic rate income tax as a byproduct of the way the internal returns are broken down between capital appreciation, income in the form of interest and dividends received.

From the public’s point of view, basic rate income tax is deemed to have been paid and the term “non-qualifying” relates to the way any additional taxation may result on taking money out of the plan. A non-taxpayer cannot reclaim any tax paid by the life company within the investment bond.

In what circumstances may a policyholder have to pay additional tax?

The liability to additional taxation comes into play in the event of a “chargeable event”. A chargeable event generally occurs if any, but not limited to, the following happen:

- Withdrawals in excess of 5% per year – up to 5% of the original amount invested can be withdrawn each year with no immediate additional tax liability – ideal for providing an “income stream” – possibly in retirement.

- Death of a life assured – if they are the last life assured remaining on the investment bond

- Partial or full surrender of the bond

- Assignment of the bond – for money or money’s worth

The calculation of liability to tax is beyond the scope of this article but in brief any additional tax liability is calculated with reference to the individuals own income tax position in the tax year in which the policy year in which surrender takes place ends – phew!!! Ask an accountant or IFA for guidance in this area.

Top Slicing

“Top slicing” of gains on investment bonds generally allows the gain to be divided by the number of complete policy years, after which this “slice” is added to the individuals income for the tax year in question.

If this slice, when added to other income, takes the policyholder into the higher rate tax bracket then some or all of the gain may carry a liability to additional taxation (20% in the current tax year).

Again, seek professional advice before surrendering any investment bond.

Who can benefit from investing in investment bonds?

The ability to take an effective 5% annual withdrawal without any immediate additional higher rate tax liability may be attractive to higher rate taxpayers who may become basic rate taxpayers later in life.

People who have fully utilised their ISA allowances and are actively managing other investments which fully utilise their annual capital gains tax (CGT) allowance.

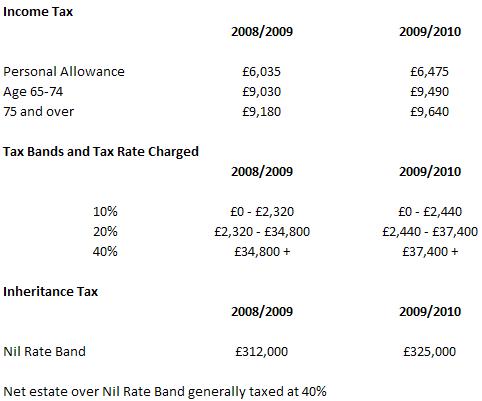

5% withdrawals are not classed as “income” – this is attractive to individuals over the age of 65 who benefit from higher annual allowances against income tax than under 65’s. For example, in the 2009/2010 tax year, a 66 year old can earn upto £9,490 before paying any income tax. Any income, such as interest or pension annuity, over a set level each year reduces this additional personal allowance,

An additional benefit to retired people is that investment bonds are not normally included in assessing a persons personal finances by a Local Authority in respect of funding long-term care. Care should be taken when considering retirement home planning and investment bonds – any action to move money into investment bonds in the period near to having to go into a retirement home could be deemed “deprivation of assets” by the local authority. More information can be found in the CRAG report.

Investment Bonds are classed as “NIPA’s” – Non-Income Producing Assets which makes them ideal for holding as part of a Discounted Gift Trust (DGT) or Gift and Loan Trust, which are both inheritance tax planning arrangements. Many life offices have their own DGT and Loan Trust packaged schemes with the core investment held in an investment bond due to the favourable tax treatment of investment bonds within a trust arrangement.

Conclusion

Investment Bonds can be viewed as more than just an investment – invariably they are a retirement and estate planning tool and care should be taken in taking any action in regard of investment bonds.